Virtual Credit Card

If you’re concerned about data breaches and online shopping fraud, a virtual credit card may be a good option for you. These cards generate a unique number for each transaction, protecting your actual account information from hackers. You can use a virtual card to shop online, in stores or even for recurring payments like memberships or subscription services. In addition, you can monitor your transactions in real-time. Typically, you can also create multiple cards for different merchants. If a particular company experiences a data breach, your virtual card will be invalidated and won’t expose your real account information.

Fortunately, you can get a buy virtual credit card for free from many major card issuers, including American Express, Capital One and Citibank. To get started, check out the list of cards below and look for the virtual card generation option in the card’s settings or through the mobile app. Some card issuers will offer separate virtual cards for each merchant, while others will generate a single number that works for all merchants.

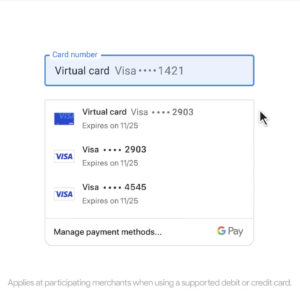

Another way to generate a virtual card is to use a special browser extension. For example, Capital One’s Eno offers a free browser extension that automatically pops up during the checkout process with instructions on how to create a virtual card for the specific merchant. This method works for all major card types, including debit and credit cards.

Where Can I Buy a Virtual Credit Card?

However, this method is not foolproof. If you don’t close the tab on your browser or log out of the session, a hacker could still steal your card numbers and other personal details. This is why it’s important to stay alert and always monitor your card statements and online accounts for suspicious activity.

In addition to reducing the risk of online fraud, virtual cards can improve organizational efficiency in business settings. For example, each virtual card can be assigned a unique accounting code for easier month-end reconciliation. This feature is especially useful for companies with employees who travel often or work from home.

Although most major card issuers offer virtual card perks, some cardholders don’t know that this option is available to them. Currently, Capital One’s ENO virtual cards and Citibank’s Virtual Payment Card are only available to cardholders who already have a eligible credit card. In the future, other banks may introduce virtual cards to more of their credit card products.

The best virtual credit cards are those that have a centralized management system and provide flexibility for online shopping and international transactions. For instance, the Visa Prepaid US Currency Card is ideal for travelers because it provides a secure way to make US purchases with ease. This card is a popular choice because it comes with a USD loading capability and US billing/shipping address that makes it easy to shop at various US retailers.

Another popular virtual card is the PayPal Virtual prepaid US Visa Debit Card, which gives users a USD-based card that can be used at many popular US retailers. This card is also a great option for freelancers and independent contractors who need a convenient way to access US retailers without having to pay foreign exchange rates. This card is a great option for US shoppers because it has no annual fee and no foreign transaction fees.